Rigid Flex PCB Complete Guide 2025: Design, Manufacturing, Cost & Applications

RayMing is a UL-certified rigid-flex PCB manufacturer specializing in high-layer-count solutions, with capabilities extending to 32-layer rigid boards and 6-layer flexible circuits. Contact us for competitive pricing quotes.

The global rigid flex PCB market is experiencing unprecedented growth, with industry analysts projecting a compound annual growth rate (CAGR) of 11.70%, reaching $77.7 billion by 2034. This explosive growth is driven by increasing demand in automotive, aerospace, consumer electronics, medical devices, and IoT applications. As electronic devices become more compact, intelligent, and versatile, rigid flex PCBs have emerged as the solution that combines the stability of rigid boards with the adaptability of flexible circuits.

What is Rigid Flex PCB?

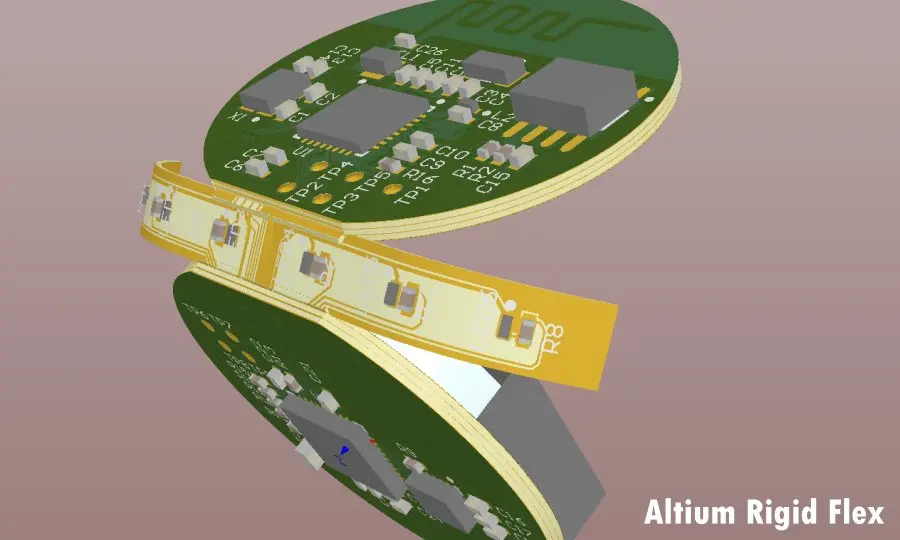

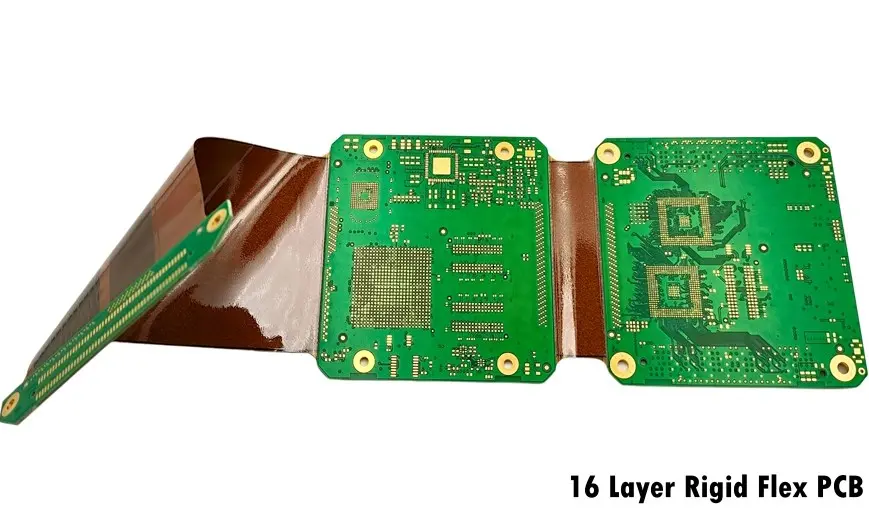

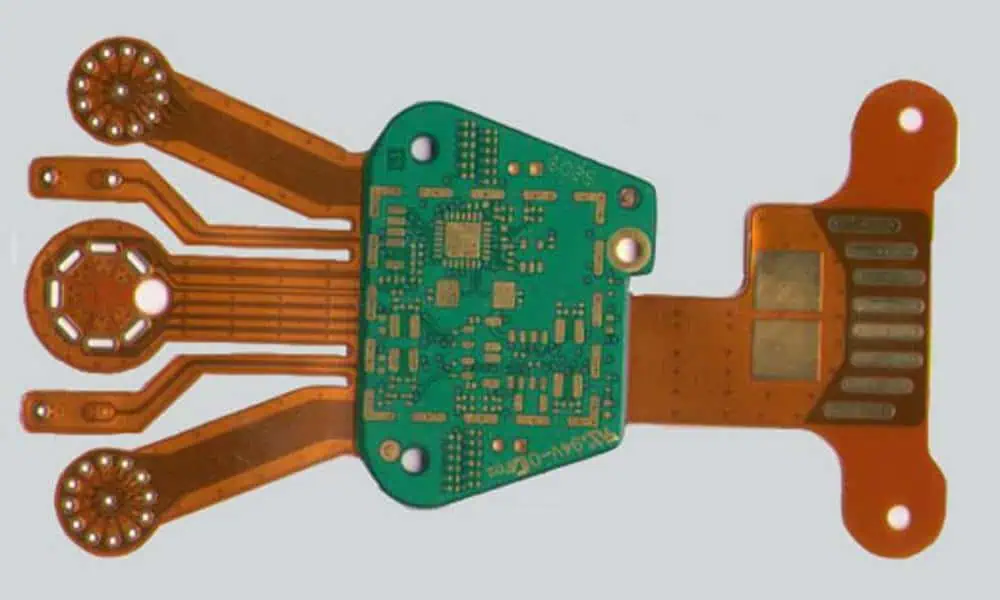

A rigid flex PCB is a sophisticated printed circuit board that integrates both rigid and flexible circuit sections into a single, unified assembly. Unlike traditional rigid PCBs that use only solid FR-4 material, or flexible PCBs made entirely of bendable polyimide, rigid flex boards strategically combine both technologies to create three-dimensional electronic solutions.

Key Components of Rigid Flex PCBs

Rigid Sections:

- Provide mechanical stability and structural support

- Use traditional materials like FR-4 or specialized laminates

- Support surface-mount components and connectors

- Offer standard mounting surfaces for assembly

Flexible Sections:

- Made from polyimide or polyester substrates

- Enable bending, folding, and dynamic movement

- Connect rigid sections without cables or connectors

- Allow three-dimensional configurations

Transition Zones:

- Critical areas where rigid and flexible sections meet

- Require careful design to prevent mechanical stress

- Use specialized materials and construction techniques

- Determine overall board reliability

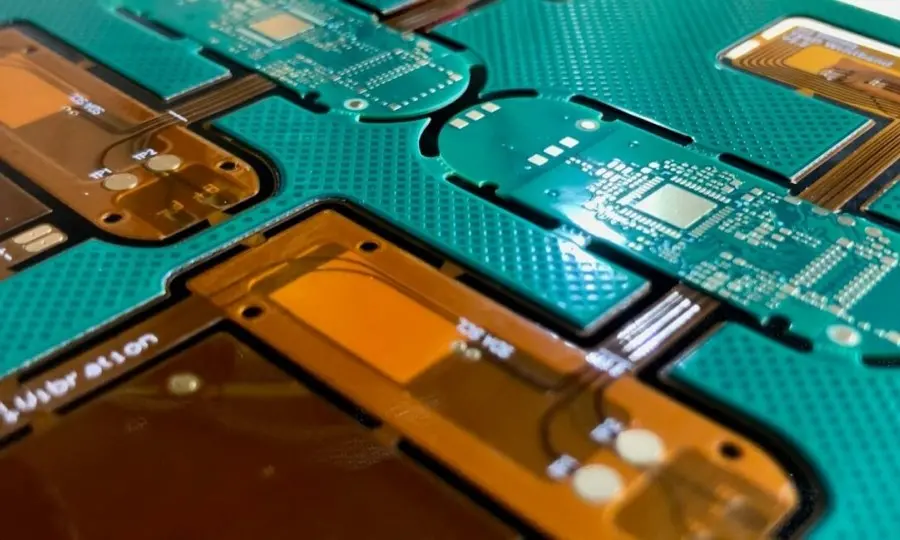

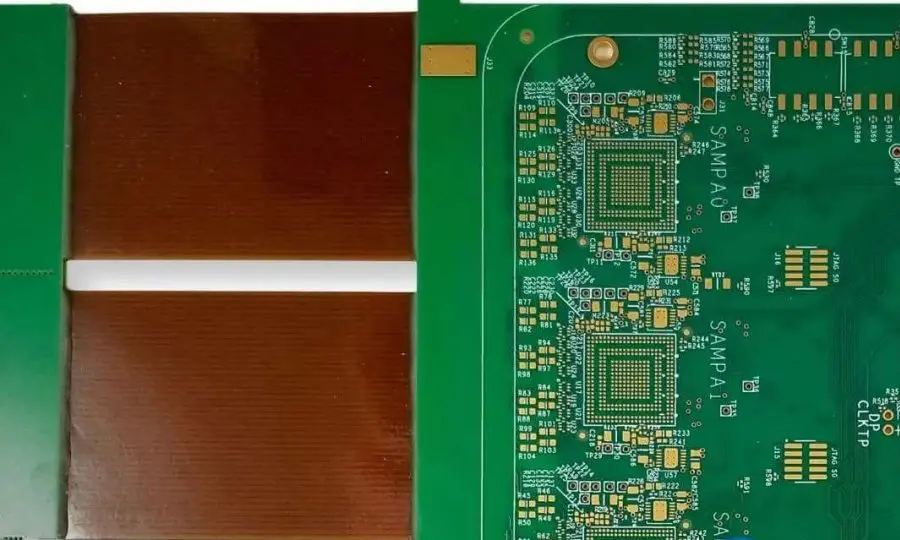

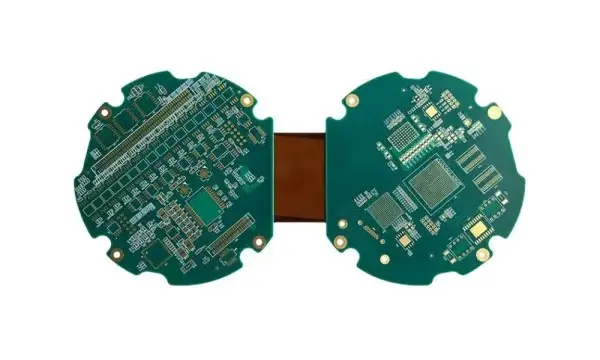

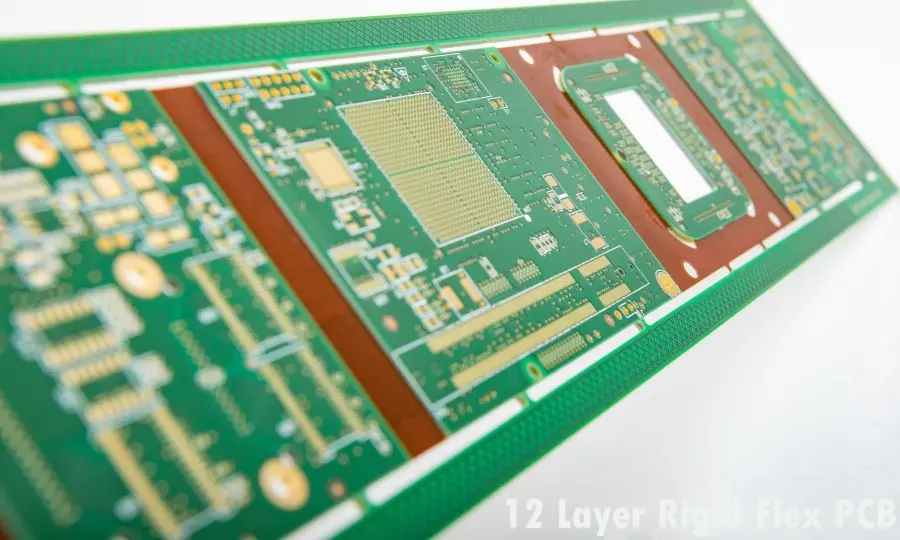

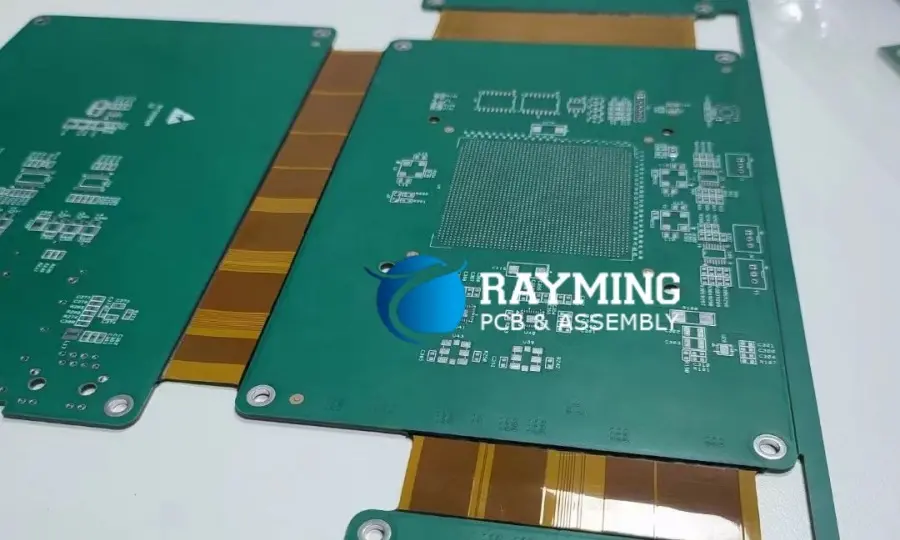

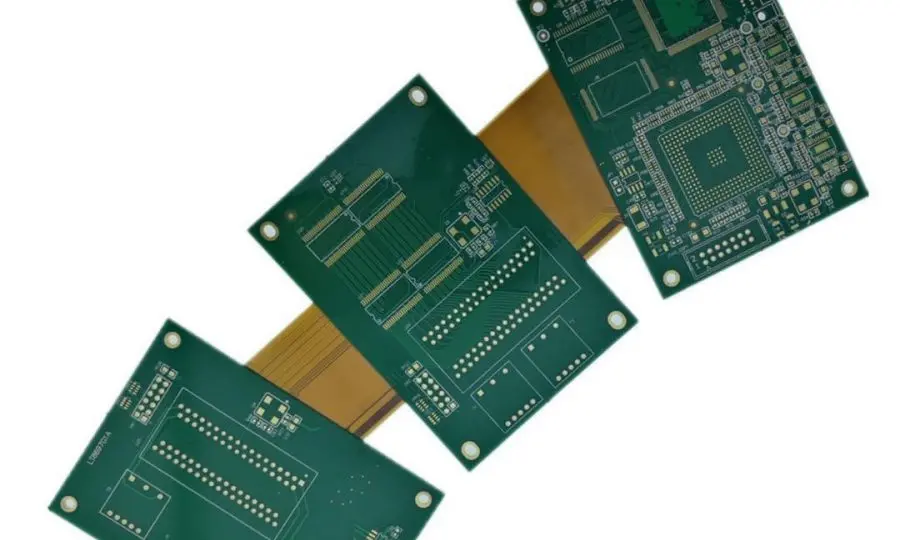

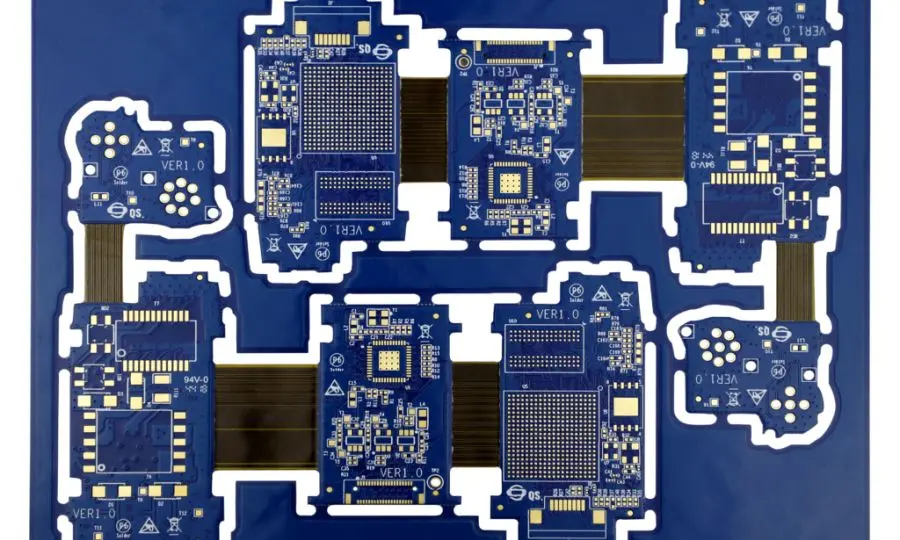

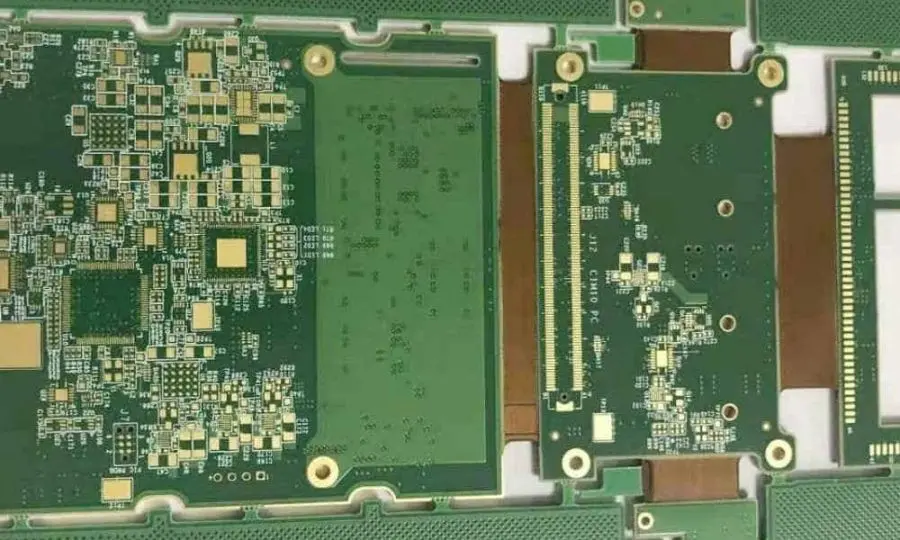

Rigid Flex PCB We Served

Types of Rigid Flex PCBs

1. Single-Sided Rigid Flex (Type 1)

- One conductive layer in flexible areas

- Simplest construction with basic bend capabilities

- Ideal for dynamic applications with tight bend radii

- Cost-effective for moderate complexity designs

2. Double-Sided Rigid Flex (Type 2)

- Two conductive layers in flexible sections

- Suitable for flex-to-install applications

- Minimal flexing after installation

- Balanced cost and functionality

3. Multi-Layer Rigid Flex (Type 3)

- Multiple flexible layers with controlled impedance

- Limited flex capability but enhanced circuit density

- Used in complex electronic systems

- Higher cost but superior performance

4. Complex Multi-Layer (Type 4)

- Adhesiveless construction for maximum reliability

- Supports hundreds of thousands of flex cycles

- Premium performance for critical applications

- Highest cost but unmatched durability

For dynamic flex applications (repeated bending), use adhesiveless constructions and Pyralux AP. For static flex (bend-to-install), standard acrylic adhesive systems are cost-effective. High-frequency designs benefit from LCP or Rogers materials with low Dk/Df values.

• Route traces perpendicular to the bend axis when possible

• Avoid vias in dynamic flex zones

• Use hatched polygons instead of solid copper planes

• Increase trace width in flex areas to reduce stress concentration

• Add teardrops at pad-to-trace transitions

Impedance is within ±10% of 50Ω target. Good for general RF applications.

| Application | Single-Ended | Differential | Notes |

|---|---|---|---|

| USB 2.0 | — | 90Ω ±10% | Data pairs D+/D- |

| USB 3.0/3.1 | — | 90Ω ±10% | SuperSpeed pairs |

| HDMI | — | 100Ω ±15% | TMDS channels |

| PCIe Gen3/4 | — | 85Ω ±15% | High-speed lanes |

| DDR4 Memory | 40Ω | 80Ω | Address/Data/DQS |

| RF/Coaxial | 50Ω ±5% | — | Standard RF |

| Ethernet | — | 100Ω ±10% | MDI pairs |

- Trace width meets minimum 3 mil requirement

- Trace spacing adequate for manufacturability

- Via diameter acceptable for laser/mechanical drill

- Annular ring provides reliable connection

- Via-to-flex edge distance at minimum (recommend 30 mil)

- Stiffener overlap sufficient for assembly

| Parameter | Standard | Advanced | Premium |

|---|---|---|---|

| Min Trace/Space | 4/4 mil | 3/3 mil | 2/2 mil |

| Min Flex Trace Width | 4 mil | 3 mil | 2 mil |

| Min Mechanical Via | 10 mil | 8 mil | 6 mil |

| Min Laser Via | 6 mil | 4 mil | 3 mil |

| Aspect Ratio (PTH) | 8:1 | 10:1 | 12:1 |

| Layer Count | 2-8 | 2-12 | 2-20+ |

| Lead Time | 15-20 days | 10-15 days | 7-10 days |

• Minimize flex section complexity — each additional flex zone adds ~$50-100

• Use standard materials (FR4 + Polyimide) when possible

• Panel multiple boards to reduce per-unit tooling costs

• Consider HASL finish for non-fine-pitch applications

• Combine shipments for volume discounts

Design Guidelines for Rigid Flex PCBs

Designing reliable rigid flex PCBs requires understanding both electrical and mechanical engineering principles. Success depends on careful planning, proper material selection, and adherence to proven design rules.

Bend Radius Calculations

The bend radius is perhaps the most critical design parameter for rigid flex PCBs. Insufficient bend radius leads to copper cracking, delamination, and catastrophic failure.

For Dynamic Flexing Applications:

- Minimum bend radius = 100 × flexible thickness

- Use maximum 2 layers in flex areas

- Expect 200,000+ bend cycles with proper design

- Consider material fatigue over product lifetime

For Static Bend Applications:

- Minimum bend radius = 10 × flexible thickness

- Allow for one-time installation bending

- More layers acceptable in flex areas

- Focus on installation stress rather than cyclic fatigue

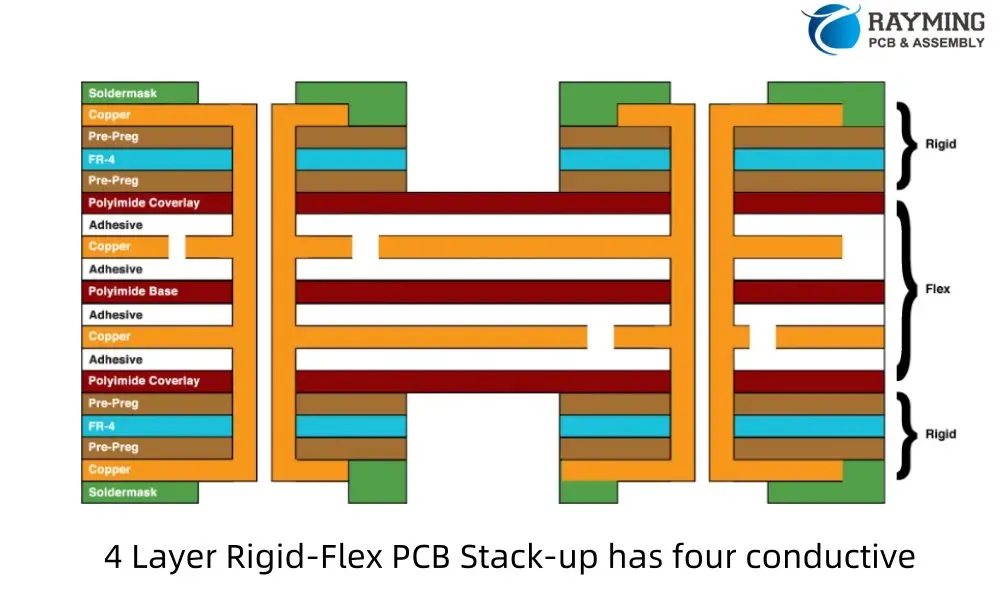

Layer Stack-Up Design

Proper stack-up design is essential for manufacturing success and long-term reliability. The arrangement of rigid and flexible layers affects cost, performance, and manufacturability.

Best Practices:

- Position flexible layers in the center of the stack-up

- Use even number of layers for balanced construction

- Avoid exposing flex layers to outer surfaces

- Implement proper copper balancing across all layers

Material Selection:

- Flexible Substrates: Polyimide preferred for reliability and temperature resistance

- Rigid Cores: FR-4 for standard applications, specialized laminates for high-performance needs

- Prepregs: No-flow or low-flow types prevent resin bleed into flex areas

- Adhesives: Acrylic or epoxy systems for coverlay attachment

Via and Pad Placement

Strategic placement of vias and pads is crucial for mechanical reliability and manufacturing success.

Critical Rules:

- Keep vias at least 20 mils from bend areas

- Use minimum 8-mil annular rings for mechanical strength

- Maintain 8-mil drill-to-copper spacing for alignment accuracy

- Avoid placing holes in high-stress transition zones

Pad Design:

- Use teardrops to connect traces to pads

- Implement anchoring for plated holes in flex areas

- Maintain minimum 10-mil hole diameter in flexible sections

- Position critical pads on rigid sections when possible

Routing and Trace Design

Proper trace routing in flexible areas directly impacts reliability and signal integrity.

Routing Guidelines:

- Run traces perpendicular to bend lines

- Use curved traces instead of sharp angles

- Maintain consistent trace spacing across flex areas

- Implement dummy traces for mechanical reinforcement

Signal Integrity Considerations:

- Control impedance across rigid-to-flex transitions

- Use hatched pour patterns instead of solid copper planes

- Minimize trace width variations in flex areas

- Consider crosstalk in dense routing scenarios

Transition Zone Design

The transition from rigid to flexible sections represents the most critical design challenge. Poor transition design leads to premature failure and reliability issues.

Design Requirements:

- Implement keep-out areas near rigid-flex boundaries

- Use gradual thickness transitions to minimize stress concentration

- Ensure proper coverlay overlap with rigid sections

- Follow IPC-2223 guidelines for minimum separation distances

Manufacturing Process

Rigid flex PCB manufacturing combines the complexities of both rigid and flexible circuit production, requiring specialized equipment, materials, and expertise.

Material Preparation

Substrate Preparation:

- Cut rigid and flexible laminates to precise dimensions

- Inspect materials for defects and contamination

- Control humidity and temperature during handling

- Verify material specifications and certifications

Stack-Up Assembly:

- Position flexible layers according to design requirements

- Use registration pins for precise layer alignment

- Apply no-flow prepregs to prevent resin migration

- Implement temporary protective films during processing

Lamination Process

The lamination process for rigid flex PCBs is significantly more complex than standard PCB lamination, requiring multiple press cycles and specialized tooling.

Multi-Step Lamination:

- Initial Flex Layer Lamination: Flexible circuits are laminated first with controlled pressure and temperature

- Rigid Section Attachment: Rigid sections are laminated to the flexible assembly using specialized adhesives

- Final Consolidation: Complete stack-up receives final lamination with optimized pressure profiles

Critical Parameters:

- Temperature profiles optimized for different materials

- Pressure distribution to prevent flex area damage

- Vacuum application to eliminate air entrapment

- Cool-down rates to minimize thermal stress

Drilling and Routing

Precision drilling and routing operations require specialized equipment and techniques due to the mixed-material construction.

Drilling Considerations:

- Use backup materials to prevent tear-out in flexible areas

- Employ specialized drill bits for polyimide materials

- Implement progressive drilling for different material zones

- Control feed rates and spindle speeds for each material type

Routing Challenges:

- Flexible areas require different routing parameters

- Support structures needed to prevent material movement

- Specialized tooling for clean edge profiles

- Contamination control during routing operations

Plating and Finishing

Plating operations must accommodate the different expansion coefficients and handling requirements of mixed-material boards.

Plating Process:

- Use fixtures to support flexible areas during plating

- Control current density to prevent burning

- Ensure uniform plating thickness across different materials

- Implement multiple plating cycles for complex geometries

Surface Finishes:

- ENIG (Electroless Nickel Immersion Gold): Most common for rigid flex applications

- HASL: Lower cost but not recommended for fine-pitch designs

- OSP: Suitable for specific applications but limited shelf life

- Gold Plating: Premium option for high-reliability applications

Quality Control and Testing

Rigid flex PCBs require enhanced quality control measures due to their complexity and critical applications.

Inspection Methods:

- Automated Optical Inspection (AOI): Detects manufacturing defects

- X-ray Inspection: Reveals internal defects and layer alignment

- Microsectioning: Validates layer stack-up and plating quality

- Bend Testing: Verifies flex area performance under stress

Electrical Testing:

- Continuity Testing: Verifies all connections function properly

- Impedance Testing: Ensures signal integrity requirements are met

- High-Voltage Testing: Validates insulation properties

- Functional Testing: Confirms overall board performance

Cost Analysis and Pricing Factors

Understanding rigid flex PCB costs is crucial for project budgeting and design optimization. These boards typically cost 2-5 times more than equivalent rigid PCBs due to specialized materials, complex manufacturing, and lower yields.

Primary Cost Drivers

1. Material Costs (40-50% of total cost)

- No-Flow Prepregs: $1.50-$3.00 per square foot vs. $0.25 for standard prepregs

- Polyimide Substrates: Significantly more expensive than FR-4

- Specialized Adhesives: Higher cost than standard bonding films

- Coverage Materials: Polyimide coverlays cost more than solder mask

2. Manufacturing Complexity (25-35% of total cost)

- Multiple Lamination Cycles: Increased processing time and energy costs

- Specialized Equipment: Requires dedicated tooling and fixtures

- Lower Yields: Higher defect rates increase per-unit costs

- Extended Cycle Times: Longer manufacturing processes

3. Design Complexity (15-25% of total cost)

- Layer Count: Each additional layer increases cost exponentially

- Flex Area Ratio: More flexible area means higher material costs

- Feature Density: HDI features and microvias add processing costs

- Special Requirements: Controlled impedance, blind vias increase complexity

Typical Pricing Structure

Cost per Square Inch by Complexity:

- Simple 2-4 Layer: $0.35-$0.45 per square inch per layer

- Medium 6-8 Layer: $0.50-$0.75 per square inch per layer

- Complex 10+ Layer: $0.80-$1.50 per square inch per layer

- High-End Military/Aerospace: $2.00+ per square inch per layer

Volume Impact on Pricing:

- Prototype (1-10 pieces): 300-500% premium over production pricing

- Low Volume (25-100 pieces): 150-200% premium

- Medium Volume (500-1000 pieces): 50-75% premium

- High Volume (5000+ pieces): Production baseline pricing

Regional Pricing Variations:

- Asia (China, Taiwan): Lowest cost, highest volume capability

- Europe: 20-30% premium, shorter lead times for local customers

- North America: 30-50% premium, best IP protection and quality

Cost Optimization Strategies

Design Optimization:

- Minimize layer count while meeting functionality requirements

- Reduce flex area ratio by consolidating rigid sections

- Use standard materials and thicknesses when possible

- Avoid unnecessary HDI features and tight tolerances

Volume Planning:

- Plan for higher volumes to achieve better pricing

- Consider multiple projects to reach volume breaks

- Use standard lead times to avoid rush charges

- Implement design-for-manufacturing principles early

Supplier Strategy:

- Work with manufacturers during design phase

- Get quotes from multiple suppliers for comparison

- Consider total cost including logistics and support

- Evaluate long-term supplier relationships

Applications and Industries

Rigid flex PCBs have found widespread adoption across industries where space constraints, reliability requirements, and performance demands exceed the capabilities of traditional PCB technologies.

Consumer Electronics

The consumer electronics market represents the largest application segment for rigid flex PCBs, driven by the demand for compact, lightweight devices.

Smartphones and Tablets:

- Main board to display connections

- Camera module interconnects

- Battery management systems

- Antenna integration solutions

Wearable Devices:

- Smartwatch mainboards that wrap around curved housings

- Fitness tracker sensor interconnections

- Hearing aids requiring miniature form factors

- Smart glasses with space-constrained designs

Gaming and Entertainment:

- VR headset display connections

- Gaming controller flexible interconnects

- Portable gaming device mainboards

- Audio equipment with space optimization needs

Automotive Industry

The automotive sector is experiencing explosive growth in rigid flex PCB adoption, driven by electrification, autonomous driving, and advanced infotainment systems.

Electric Vehicle Applications:

- Battery management system interconnects

- Charging system control modules

- Motor control electronics

- Thermal management sensors

Advanced Driver Assistance Systems (ADAS):

- Camera and sensor module connections

- Radar system interconnects

- LiDAR sensor assemblies

- Central processing unit interfaces

Infotainment and Connectivity:

- Dashboard display connections

- Navigation system interfaces

- Wireless charging modules

- Connectivity hub assemblies

Aerospace and Defense

Military and aerospace applications demand the highest reliability standards, making rigid flex PCBs ideal for mission-critical systems.

Commercial Aerospace:

- Flight control system interfaces

- Communication equipment interconnects

- Navigation system assemblies

- Passenger entertainment systems

Defense Applications:

- Military communication systems

- Guidance system electronics

- Surveillance equipment connections

- Ruggedized computing platforms

Satellite Technology:

- Solar panel deployment mechanisms

- Communication array interfaces

- Attitude control system connections

- Instrument package assemblies

Medical Devices

The medical device industry relies on rigid flex PCBs for compact, reliable solutions that meet strict regulatory requirements.

Implantable Devices:

- Pacemaker lead connections

- Cochlear implant assemblies

- Insulin pump control systems

- Neural stimulation devices

Diagnostic Equipment:

- Ultrasound probe assemblies

- MRI scanner interface connections

- CT scanner detector arrays

- Laboratory analyzer systems

Surgical Instruments:

- Robotic surgery system connections

- Laparoscopic tool interfaces

- Electrosurgical device assemblies

- Minimally invasive instrument designs

Industrial and IoT Applications

Industrial automation and IoT devices increasingly utilize rigid flex PCBs for reliable operation in harsh environments.

Factory Automation:

- Robotic arm joint connections

- Conveyor system sensor interfaces

- Production line control systems

- Quality inspection equipment

IoT Devices:

- Smart sensor assemblies

- Gateway device interfaces

- Environmental monitoring systems

- Asset tracking device connections

Advantages and Challenges

Key Advantages

Space Efficiency: Rigid flex PCBs enable three-dimensional packaging that can reduce overall product volume by 40-60%. This space efficiency is crucial in applications where every millimeter counts, such as smartphones, medical implants, and aerospace systems.

Enhanced Reliability: By eliminating connectors and cables between rigid sections, rigid flex PCBs reduce potential failure points by up to 75%. Each eliminated connection represents one less assembly step and one less opportunity for failure during the product lifecycle.

Improved Signal Integrity: Integrated design eliminates signal degradation associated with connectors and cables. This is particularly important in high-frequency applications where signal integrity directly impacts system performance.

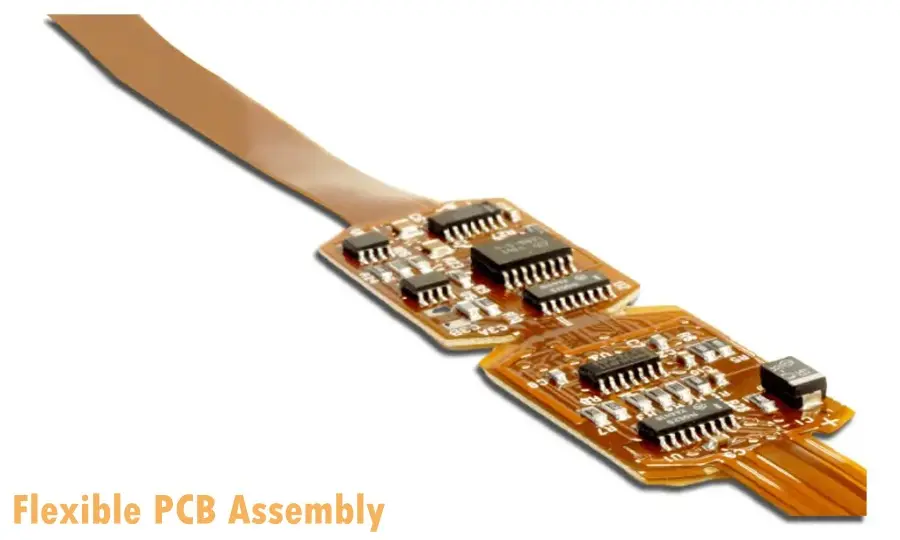

Reduced Assembly Complexity: Rigid flex boards arrive pre-assembled, eliminating manual cable routing and connector assembly. This reduces labor costs and potential assembly errors while improving production throughput.

Weight Reduction: Compared to equivalent multi-board solutions with cables and connectors, rigid flex assemblies can reduce total system weight by 20-40%, critical in aerospace and portable device applications.

Enhanced Durability: Properly designed rigid flex assemblies can withstand over 200,000 flex cycles with standard polyimide materials, far exceeding the durability of cable-based solutions.

Design and Manufacturing Challenges

Complex Design Rules: Rigid flex PCBs require understanding of both electrical and mechanical engineering principles. Designers must consider bend radii, material properties, thermal expansion coefficients, and manufacturing constraints simultaneously.

Higher Initial Costs: Initial fabrication costs are typically 2-5 times higher than equivalent rigid board solutions due to specialized materials and manufacturing processes.

Material Selection Complexity: Different thermal expansion coefficients between rigid and flexible materials can cause reliability issues during temperature cycling. Proper material selection requires careful analysis of operating conditions.

Manufacturing Yield Issues: The complex manufacturing process results in lower yields compared to standard rigid boards, particularly for first-time designs or complex geometries.

Testing and Inspection Challenges: Three-dimensional configurations make automated testing and inspection more difficult, often requiring specialized fixtures and procedures.

Supply Chain Complexity: Fewer suppliers offer rigid flex capabilities compared to standard PCBs, potentially creating supply chain constraints and longer lead times.

Market Trends and Future Outlook

Current Market Dynamics

The rigid flex PCB market is experiencing robust growth driven by several key trends:

5G Technology Expansion: The global rollout of 5G networks is driving demand for compact, high-performance PCBs that support complex circuitry in space-constrained applications. Rigid flex technology is particularly well-suited for 5G-enabled devices due to its ability to handle high-speed, high-frequency signals without degradation.

IoT Device Proliferation: With global IoT connections expected to reach 5.9 billion by 2027, the demand for miniaturized, flexible, and durable PCBs continues to accelerate. IoT devices operate in diverse environments requiring robust, space-efficient solutions that rigid flex technology provides.

Automotive Electronics Growth: The automotive industry’s shift toward electric vehicles and autonomous driving is creating unprecedented demand for reliable, compact electronic systems. Rigid flex PCBs are increasingly used in ADAS modules, where a leading automotive electronics manufacturer reported a 40% increase in usage.

Medical Device Innovation: Advanced medical devices increasingly require compact, reliable circuit solutions. Healthcare technology companies are introducing wearable cardiac monitoring devices leveraging rigid flex PCBs for compactness and enhanced signal accuracy, achieving device size reductions of 25% compared to previous models.

Regional Market Analysis

Asia-Pacific Dominance: The Asia-Pacific region dominates the global rigid flex PCB market with over 35.3% market share, translating to approximately $9 billion in revenue. Government policies such as China’s “Made in China 2025” plan and South Korea’s semiconductor investments are driving high-tech industry growth.

North American Innovation: North America leads in high-value applications, particularly in aerospace, defense, and medical devices. The region focuses on premium quality and advanced technology applications despite higher manufacturing costs.

European Specialization: Europe specializes in automotive and industrial applications, with strong emphasis on quality standards and regulatory compliance.

Technology Developments

Advanced Materials: Development of new polyimide formulations offering improved flexibility, temperature resistance, and signal integrity performance.

Manufacturing Process Improvements: Implementation of advanced automation and quality control systems to improve yields and reduce manufacturing costs.

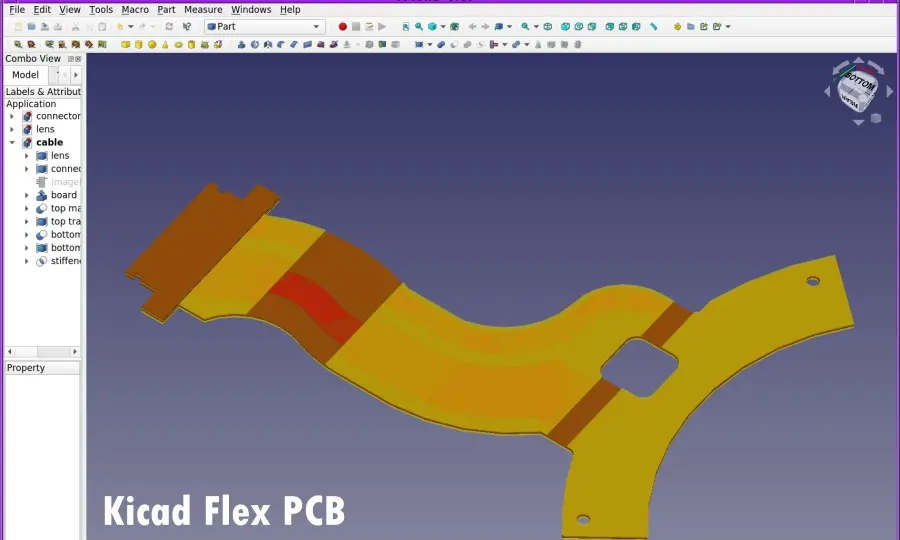

Design Tool Evolution: Enhanced CAD tools supporting 3D visualization, mechanical simulation, and design rule checking specific to rigid flex applications.

Future Growth Projections

Industry analysts project continued strong growth through 2034, with key drivers including:

- Miniaturization Trend: Continued demand for smaller, more complex electronic devices

- Electric Vehicle Adoption: Growing EV market requiring advanced electronic systems

- Wearable Technology Expansion: Increasing adoption of health monitoring and fitness devices

- Industrial IoT Growth: Factory automation and smart manufacturing initiatives

Best Practices and Recommendations

Design Phase Best Practices

Early Manufacturer Involvement: Engage with rigid flex PCB manufacturers during the design phase to ensure manufacturability and optimize costs. Experienced manufacturers can provide valuable guidance on material selection, stack-up design, and cost optimization strategies.

Design Rule Validation: Implement comprehensive design rule checks specific to rigid flex requirements, including bend radius validation, via placement verification, and material transition analysis.

Simulation and Modeling: Use advanced simulation tools to model mechanical stress, thermal behavior, and signal integrity before committing to fabrication. This helps identify potential issues early in the design process.

Prototyping Strategy: Plan for multiple prototype iterations to validate mechanical performance, electrical functionality, and manufacturing feasibility. Build in schedule and budget allowances for design refinements.

Manufacturing Phase Recommendations

Supplier Qualification: Thoroughly evaluate potential suppliers based on technology capabilities, quality systems, delivery performance, and cost competitiveness. Consider visiting manufacturing facilities to assess capabilities firsthand.

Quality Planning: Develop comprehensive quality plans including incoming material inspection, in-process monitoring, and final acceptance criteria. Define clear specifications for all critical parameters.

Risk Mitigation: Implement risk mitigation strategies including supplier redundancy, inventory management, and contingency planning for potential supply chain disruptions.

Long-Term Success Strategies

Technology Roadmap: Develop long-term technology roadmaps that anticipate future requirements and plan for technology transitions. Stay informed about emerging materials and manufacturing technologies.

Supply Chain Management: Build strong relationships with key suppliers and implement supply chain management practices that ensure consistent quality and delivery performance.

Continuous Improvement: Implement continuous improvement processes that capture lessons learned and drive ongoing optimization of designs, processes, and supplier relationships.

Conclusion

Rigid flex PCBs represent a transformative technology that enables innovative electronic designs previously impossible with traditional PCB technologies. While they present design and manufacturing challenges, the benefits of space efficiency, enhanced reliability, and improved performance often justify the investment.

Success with rigid flex technology requires understanding the complex interplay between materials, design rules, manufacturing processes, and cost factors. Early supplier involvement, comprehensive design validation, and careful attention to manufacturing requirements are essential for achieving optimal results.

As the market continues to grow at double-digit rates, driven by applications in 5G devices, electric vehicles, IoT systems, and advanced medical devices, rigid flex PCBs will play an increasingly important role in enabling the next generation of electronic products.

The key to success lies in thorough planning, proper design practices, and close collaboration with experienced manufacturers. Organizations that master rigid flex technology will be well-positioned to create innovative products that meet the demanding requirements of tomorrow’s electronic systems.

Whether you’re developing a compact medical device, an automotive control system, or a next-generation consumer product, rigid flex PCBs offer the design flexibility and performance capabilities to bring your vision to reality. The investment in understanding and implementing this technology will pay dividends in product performance, reliability, and market competitiveness.